London-based vertical farming technology firm Vertical Future has entered administration, marking a formal escalation of the sale process first reported at the end of July. Public filings at Companies House show that Richard Cole and Steve Kenny of KBL Advisory were appointed joint administrators on 5 August 2025, and that multiple directors, including CEO Jamie Burrows, ceased to be directors effective 8 August 2025.

This development comes just weeks after Vertical Future was publicly listed for sale via an insolvency marketplace, following a dramatic drop in turnover and financial losses exceeding £10 million. At the time, the company said it had engaged advisors to explore strategic options, including a potential sale, in response to mounting financial pressures and a failed £60 million funding round. © KBL Advisory

© KBL Advisory

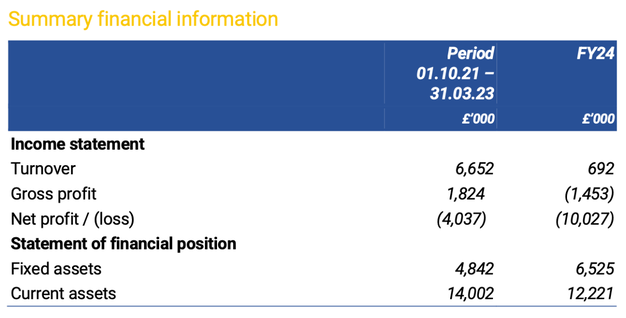

A financial summary showing a sharp decline in turnover and a significant widening of losses for Vertical Future.

Administrator-led sale now underway

In late July, KBL Advisory posted a LinkedIn announcement promoting an acquisition opportunity involving a "globally recognised technology (hardware and SaaS) business, specialised in the agritech sector," understood to be Vertical Future.

The post referenced vertical integration across the value chain, in-house data science capabilities, and advanced manufacturing of vertical farms. While not naming the company directly, the post's timing and content aligned with details of Vertical Future's operation and its earlier public statement about seeking a buyer. According to KBL's Project Scale document, likely first shared with prospective buyers, indicative offers were requested by 4 August 2025.

The KBL LinkedIn post with the "Project Scale" sale document attached.

Governance changes and signs of distress

Vertical Future's decline had been unfolding quietly behind the scenes. In mid-July, the company changed its registered office address and added a new director to its board, moves that signaled internal repositioning ahead of a formal restructuring.

Within three weeks, those changes culminated in multiple board resignations effective 8 August and the appointment of administrators effective 5 August, both actions filed and published on 13 August on Companies House. On the same day, the registered office was moved again to Stamford House, Northenden Road, Sale, Cheshire, which corresponds to KBL Advisory's head office.

At the time of its listing for sale, Vertical Future employed 32 staff, confirmed by KBL Advisory's Project Scale document. It remains unclear how existing commercial and research commitments will be handled under administration.

For more information:

KBL Advisory

Richard Cole and Steve Kenny

[email protected]

www.kbl-advisory.com

Vertical Future

Jamie Burrows, Founder and CEO

[email protected]

www.verticalfuture.co.uk