The horticulture sector is drawing renewed interest from Private Equity investors, driven by both internal industry dynamics and a stabilizing market environment. In a a newly published overview, consultancy firm Oaklins provides an overview, stating that prior to 2020, the horticulture market was widely viewed as a stable, low-volatility sector. PE interest had accelerated over the years, driven by the sector's limited correlation with the broader economy, resilient demand fundamentals, and meaningful consolidation potential.

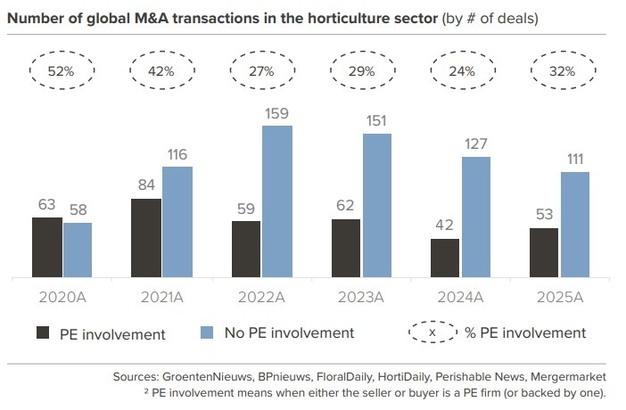

The COVID-19 period — first boosting floriculture and then driving a sharp correction — disproved earlier assumptions of structural stability. The subsequent energy crisis further exposed the vulnerability of the entire horticultural industry, with many companies directly or indirectly impacted by high gas prices. After this period of caution, PE investors are now turning back to the horticulture sector. Both ornamental and edible segments are seeing renewed interest. Deal data reflects this trend: after PE involvement declined from 52% in 2020 to ~25% between 2022 and 2024, it has begun to recover, reaching 32% in 2025, signaling renewed confidence in the sector's fundamentals.

© Oaklins

© Oaklins

"After several years of caution, we clearly see private equity investors returning to horticulture. The focus is sharper, more selective, and centered on resilience and scalability rather than volume alone," says Frank de Hek, Partner at Oaklins. "While a return to pre-2020 PE activity is unlikely in the short term, we expect a growing pipeline of transactions, particularly among companies with: i) scalable and differentiated models; ii) resilience to input-cost volatility; and iii) strong management teams. As such, PE involvement is expected to increase gradually, with continued focus on platform-building, buy-and-build strategies, and operational value creation."

© Oaklins

© Oaklins

Varieties

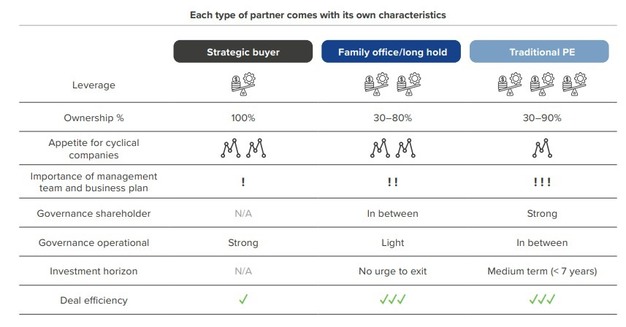

PE firms exist in many varieties and mainly differ from each other in terms of investment strategy and horizon. Some prefer to invest in companies with strong growth opportunities, while others target steady cash flows or financially distressed companies in need of a turnaround. Some PE firms take a more hands-on approach, getting closely involved in the day-to-day operations of their portfolio companies. Others are more hands-off, giving management teams the freedom to run the business independently. The vast majority take the latter approach.

The investment period — the period a PE firm is invested in a company — also differs. Traditionalists work with an investment period of 4–6 years, while others (usually family, evergreen, or buy-and-hold funds) do not have a fixed investment period and could remain invested in a company for much longer. This difference stems from the fund structure: most PE firms are closed-end funds, typically with a period of 10 years to acquire companies and sell them again, returning the money to the fund's investors. Conversely, open-end funds can remain invested indefinitely.

Another important distinction is between generalist and specialist PE firms. Generalists invest across a wide range of industries and tend to focus primarily on financial performance and operational improvement. Specialist firms, on the other hand, concentrate on a specific sector — for example, food & agri. This allows them to bring in-depth industry knowledge, a strong sector network, and more tailored strategic support.

"In horticulture especially, sector knowledge matters. Specialist investors are often better positioned to add real strategic value beyond capital," notes Frank. Beyond providing capital, PE firms often accelerate growth by contributing knowledge on building a more successful and professional company, facilitating the succession of the owner/CEO, accelerating geographic and market expansion, driving operational excellence and rationalizing activities, unlocking M&A potential, and enhancing financial performance. Therefore, partnering with a PE firm is emerging as a compelling alternative to a strategic sale. This path enables owners to realize partial liquidity, maintain a level of independence, and access the growth capital and expertise needed to take their business to the next stage, making it an appealing exit solution and a springboard for further value creation.

Frank explains PE firms are increasingly drawn to horticulture companies for several reasons. "First, many horticultural businesses generate stable cash flows with high cash conversion, providing a reliable foundation for debt servicing and reducing overall investment risk. In addition, many players maintain a strong market position, often within specialized niches such as tree nurseries, advanced equipment and robotics, and growers. These niches benefit from pricing power and serve as a natural hedge against broader market volatility." Breeding companies, by contrast, attract less PE involvement as their long-term R&D horizons often require more than 10 years of investment before results materialize.

At the same time, the horticulture sector offers significant growth opportunities, driven both by organic expansion and attractive buy-and-build strategies that allow for rapid scaling and portfolio synergies. "This potential is reinforced by the presence of experienced and capable management teams, whose expertise is essential for executing ambitious growth plans and driving operational improvements. Moreover, horticulture companies often provide substantial room for operational enhancement, ranging from efficiency gains and margin improvement to process optimization. When combined with favorable external drivers — such as technological innovation, rising sustainability requirements, and evolving customer demands — these factors make the horticulture sector particularly attractive for PE investment."

© Oaklins

© Oaklins

PE opportunities, and challenges

To offer clear and practical insight into the dynamics of partnering with a PE firm, Oaklins created a series of case studies illustrate distinct ways in which PE involvement can make a difference. Some cases emphasize growth through strategic expansion or internationalization. Others demonstrate the benefits of substantial M&A or the optimization of financial and organizational infrastructure. Across these examples, the role of a PE firm is consistently tailored to the target company's specific ambitions, challenges, and opportunities, as well as those of the entrepreneur behind the firm. These partnerships demonstrate how PE capital and expertise can unlock efficiencies, accelerate innovation, and reshape the horticultural landscape.

At the same time, partnering with a PE firm is not without challenges. "Some collaborations face hurdles that limit the anticipated impact. This may occur when a company consists of several separate entities or spin-outs that are not fully integrated, when rapid scaling requires more structure and discipline than initially present, or when there is a mismatch in culture. Management attention may also become stretched across too many priorities, causing a lack of focus, alignment, or operational rigor — ultimately slowing progress", Frank explains.

Strategic priorities

"These examples underscore that the success of a PE partnership depends not only on capital and expertise, but also on clear strategic priorities, strong execution, and close alignment between investor and entrepreneur. When these elements are in place, a partnership can be a powerful catalyst for long-term value creation in the horticultural sector. "

© Oaklins

© Oaklins

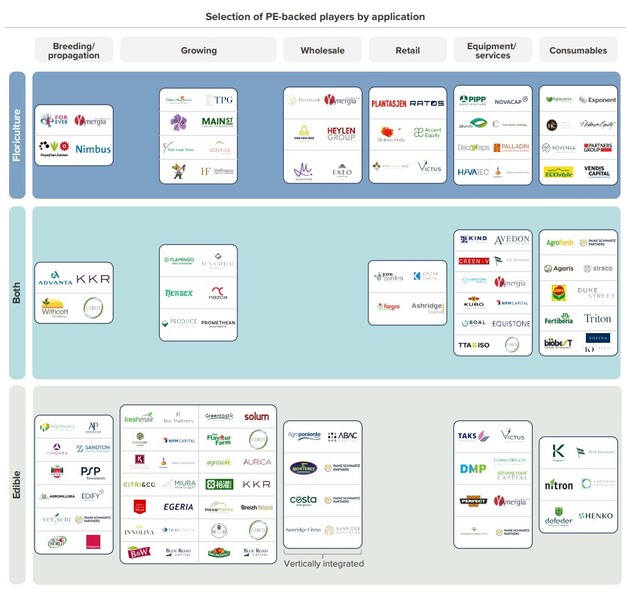

Complementing individual case studies, a broader market perspective highlights a selection of PE-backed players across the horticultural value chain, categorized by application. This mapping demonstrates where financial sponsors are currently positioned and how their activity spans breeding, growing, wholesale, retail, equipment, services, and consumables.

More consolidated market

"PE is playing an increasingly pivotal role in the professionalization of the horticulture sector", Frank concludes. "As the market grows in scale and strategic importance — particularly in addressing global food security — we're seeing a wave of newcomers entering the space, from agri-focused to sector agnostic investors. Companies increasingly partner with PE not only for capital, but also for strategic guidance, professionalization, access to networks and support in executing acquisitions. By 2030, we expect the horticultural sector to be more consolidated, efficient and internationally oriented — with financial investors and the right strategic matches acting as key enablers of this transformation."

Click here for the complete Spot On Publication.

For more information:

Frank de Hek © Oaklins

© Oaklins

Oaklins

[email protected]

www.oaklins.com